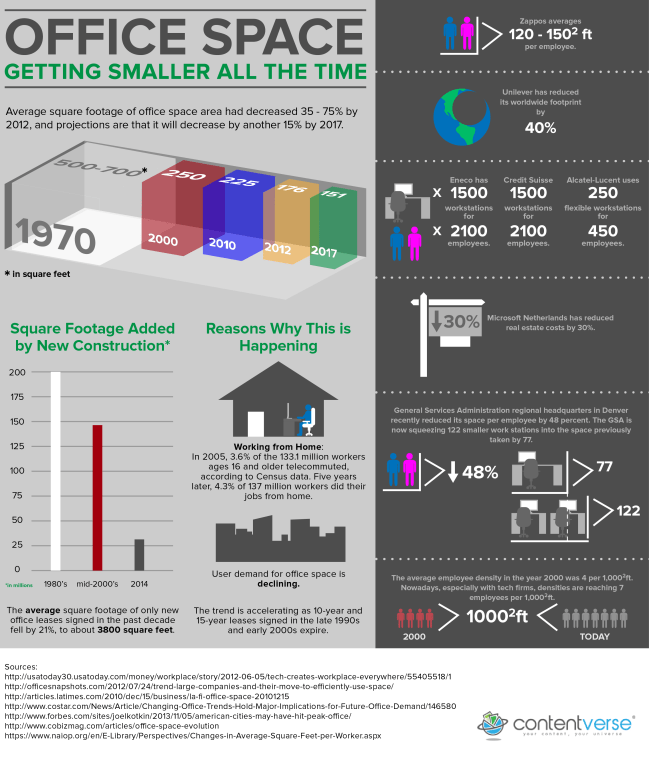

Office space is smaller than ever, and getting smaller still, according to research from CoreNet Global. Of the 465 companies surveyed, 24 percent said their staff had less than 100 square feet of workspace to call their own, while 40 percent said space would shrink to that level by 2017. Workspace has shrunk from 225 square feet in 2010 to 176 just four years later.

A recent infographic from document management software company Contentverse compiles stats on our ever-declining workspace. A few highlights :

•In the 1970s, American companies planned on at least 500 square feet per worker.

•Some tech firms have worker-to-space ratios of seven workers per 1000 square feet.

•Other companies have workers share flexible work stations. This is calling “hoteling,” as workers check in to the office and get assigned to a workspace for the day.

•Telecommuting is on the rise, as well, with over 5 million people working from home on a daily basis.

•Companies who renew their leases often cut the square footage of their space. According to commercial real estate information provider CoStar, the average square footage of commercial rentals fell 7 percent during the past 10 years.

What’s to blame for our shrinking workspace? The desire to save money and the corresponding popularity of open-plan offices are part of the picture. But the other side of the story is more positive: thanks to smaller and more portable electronics, we just don’t need as much space as we did in the older days.

Tag Archives: #CCIM

TMC The Mahr Company is available to assist you in positioning your business model in 2014. As we approach the second quarter of 2014 how are you and your business model positioned to take advantage of the emerging trends in commercial real estate? We have the skill sets, market knowledge, experience, energy and determination to take a proactive approach to achieve your goals. If you are not engaged in the game, the sidelines only offer a spectator’s view.

Finding Solutions through Creative Problem Solving

How Many Squares are in the picture depicted below?

Most popular answer is 24…

TMC-The Mahr Company knows there are more..

Let us find solutions for you where you see there is a problem.

You stay focused on what you do best, run your business/practice. TMC will provide you with options and solutions.

Based in Tampa, primarily serving Florida markets, The Mahr Company offers a unique blend of expertise and disciplines.

“Value added Commercial Real Estate Services”

TMC utilizes years of experience and professional expertise to provide you with solutions to your real estate matters. You remain focused on your business/profession with no diversions from a transaction you may only seldomly encounter. We become a member of your team likened to your business’ Senior Vice President of Real Estate.

In addition, TMC can provide the following services:

User Representation for Office, Commercial, Medical, Legal/Attorney & Investment Properties

Landlord Representation for Office, Commercial, Medical, Legal/Attorney & Investment Properties

Acquisitions and Dispositions

Land and Site Selection

Real Estate Advisory and Consulting

Real Estate Investment Sales & Marketing

Asset Value Enhancement

Special Projects for Clients

Equity Positions for Tenants through Leasing

Sale/Leasebacks

Broker Opinion Of Value (for Lenders, Asset Managers and Owners)

Expert Witness for Litigation regarding Leasing and Commercial Real Estate matters

Broker Price Opinion BPO

Finding Solutions through Creative Problem Solving

We Find Solutions through Creative Problem Solving and Execution:

TMC-The Mahr Company = SUCCESS in the achievement of your goals

Our Services solve your problems, saving you time and money.

The TMC team offers focused and skilled professional services, tailored to achieve your goals

Understanding Cash on Cash Return in Commercial Real Estate

By: Robert Schmidt

Cash on cash return in commercial real estate is important when you are evaluating investment real estate transactions. What is the cash on cash return and how do you calculate it for a commercial property? What are the limitations of using this method? In this article we’ll tackle these questions and also provide some detailed examples of the cash on cash return.

Cash on Cash Return Formula

Before diving into some cash on cash return examples, it is important to have a sound understanding of exactly what the term means. So, let’s start with the basics. First, here’s the cash on cash return formula:

![]()

As shown in the cash on cash formula above, the cash on cash return is a simple measure of investment performance that is calculated as cash flow before taxes divided by the initial equity investment. The cash flow before tax figure for each year is calculated on the real estate proforma, and the initial equity investment is simply the total purchase price less any loan proceeds.

Cash on Cash Return Example

Next, let’s take a simple example to illustrate the cash on cash return. Suppose you are evaluating an office building with an estimated Year 1 Cash Flow Before Tax of $60,000. Also, assume that the negotiated purchase price of the property is $1,200,000 and you are able to secure a loan for $900,000 (75% Loan to Value). What’s your cash on cash return for year 1?

![]()

The calculation itself is pretty simple – your cash on cash return for year 1 would be the Year 1 cash flow divided by your total cash out of pocket, which equals 20%. So what does this simple measure of investment performance tell you? Using only the figures above, the cash on cash return tells you that your year 1 return on investment is 20%. This of course assumes that your initial equity investment figure and also your cash flow projection is correct.

Cash on Cash Return Limitations

The cash on cash return is a simple measure of investment performance that is quick and easy. It can be a good starting point for quickly filtering out potential investment properties. But don’t be fooled by the many limitations of the cash on cash return.

Consider the following series of cash flows:

The year 1 cash on cash return in the levered example above shows a 3% cash on cash return. To find this simply take the end of year (EOY) 1 cash flow of $15,805 and divide it by the initial equity investment of $515,000.

But as you can see in the table above, the internal rate of return (IRR) is 10.71%. This suggests that according to a discounted cash flow analysis, the investment is actually much better (almost 4x better) than what’s indicated by the cash on cash return. If you were only using the cash on cash return as an investment filter, then you’d pass up this opportunity to earn nearly 11%.

The reason why the cash on cash return is so much lower than the IRR in the example above is because the cash on cash return ignores the other 9 years of operating cash flows in the holding period. Plus, it also ignores the reversion cash flow at the end of year 10 that comes from the sale of the asset. Without taking into account these additional cash flows that occur over the holding period, it’s impossible for the cash on cash return to accurately reflect the return characteristics of the property.

The same is true when looking at the unlevered example above. The cash on cash return in the unlevered series of cash flows above is 6.2% ($95,000 divided by $1,515,000), and the IRR is 7.51%. This series of cash flows doesn’t produce as big of a gap as in the levered example, but it’s still a difference. Without taking into account all cash flows over the holding period, the gap between the cash on cash return and the IRR will be unknown.

As a side note – keep in mind that this can work in reverse too. In the above examples the IRR was higher than the cash on cash return because operating cash flows grow over the holding period and the sales proceeds of the asset are favorable. But it could also be the case that many leases will expire a few years after acquisition, causing operating cash flow to decline and the final reversion cash flow to be lower. This could produce the opposite result where the cash on cash return ends up being more favorable than the IRR.

Discounted Cash Flow Analysis

As shown in the example above, a discounted cash flow analysis provides a much more complete return profile of an investment property. Sure, simple measures of investment performance like the cash on cash return work as a starting point in your evaluation. But as your interest in a property becomes more serious, so should your analysis.

A discounted cash flow analysis uses concepts of the time value of money to value a commercial real estate asset. When looking at a time period extending out over a number of years, a DCF analysis estimates future cash flows and discounts cash flows back to the present. Using the discounted cash flow analysis will require forecasting future cash flows (incoming and outgoing), determining the necessary total return, and then discounting the forecasted cash flows back to the present at the necessary rate of return.

Sourced By: Property Metrics

We Are Dedicated To Serving YOU

We are dedicated to serving you. To being the best we can be in your service and in the accomplishment of your goals. As such we embrace this approach to being a more efficient, productive and entrepreneurial business to best serve you.

The below was created by: Anna Vital infographic author http://anna.vc/

TMC-The Mahr Company EXCELLENCE IN THE DETAILS:

Selectively working with clients and prospective clients, while building lifelong working relationships.

Our Services solve your problems, saving you time and money.

The TMC team offers focused and skilled professional services, tailored to achieve your goals

Lessons Learned From Outside The Industry

TMC The Mahr Company lessons from outside the industry: [The Seattle Seahawks, Bono and U2, and Bank of America]: (1) Reinvent with CANEI (Constant and Never Ending Improvement), (2) Stay with or ahead of trends, (3) Brand, Promote, Execute, Deliver,(4) Contribute to the greater good, (4) Dare to excel and surround yourself with talented motivated people desiring the same, (5) Do not accept other’s preconceived expectations,(6) Failure is not an option, Take action and act as if it is impossible to fail, (7) Proceed as if limits to your ability do not exist: The Seattle Seahawks Nail it. Nike transforms their uniforms to perhaps the coolest in the NFL, Bono and U2 deliver for the Bank of America in support of RED with “Invisible”, Coach Carroll assembles a team with talent to spare. they execute and deliver….. Follow this link for U2’s “Invisible” http://bit.ly/1iljxDF

TMC The Mahr Company lessons from outside the industry: [The Seattle Seahawks, Bono and U2, and Bank of America]: (1) Reinvent with CANEI (Constant and Never Ending Improvement), (2) Stay with or ahead of trends, (3) Brand, Promote, Execute, Deliver,(4) Contribute to the greater good, (4) Dare to excel and surround yourself with talented motivated people desiring the same, (5) Do not accept other’s preconceived expectations,(6) Failure is not an option, Take action and act as if it is impossible to fail, (7) Proceed as if limits to your ability do not exist: The Seattle Seahawks Nail it. Nike transforms their uniforms to perhaps the coolest in the NFL, Bono and U2 deliver for the Bank of America in support of RED with “Invisible”, Coach Carroll assembles a team with talent to spare. they execute and deliver….. Follow this link for U2’s “Invisible” http://bit.ly/1iljxDF

The Key To Investing in Commercial Real Estate Is Timing. Ask us how we can assist you in identifying the right strategies for your commercial real estate investments, whether acquisitions or dispositions.

Market Analysis: “A Stronger Asset” from CCIM Institute

The current economic landscape has assembled an array of factors to structurally change real estate investment standards. The intertwining of the U.S. and global economies, deeper integration of liability and equity markets, and the accelerated adoption of real estate investment trusts and commercial mortgage-backed securities as major components of the sector have all contributed to this evolution. Furthermore, increased access to a variety of capital sources, combined with a multitude of real estate investment vehicles, has resulted in real estate investment earning its place as a mainstream asset class.

For today’s real estate investor, advanced facts and figures, deeper liquidity, and a range of broad investment opportunities that reach beyond merely primary metros have all allowed the further mitigation of risk. As supply cycles continue their two-decade trend of stabilization, the sector remains less volatile as a whole. Convergence of these influences has refined the foundation for attractive real estate cost positioning, resulting generally in falling capitalization rates over the last 20 years.

Cap Rate Movement

Typically, cap rates are inclined to stay range-bound during economic inflection points, with a usual variance of between 100 and 130 basis points. Whereas the length and severity of the the 2009 Great Recession and the 2001 Recession were markedly different, the recovery trends of cap rate performance proved surprisingly similar.

During the peak of the financial crisis, cap rates expanded from 6.9 percent to 8.1 percent between 2007 and 2009 before making a remarkably accelerated recovery, especially given the depth of the recession, according to figures from Real Capital Analytics, CoStar, and Marcus & Millichap Research Services. While the annualized yield on the 10-year Treasury declined 280 basis points to 1.8 percent between 2002 and 2012, the mean annualized cap rate for all property types dropped 150 basis points. Since the end of 2012, the 10-year yield has abruptly expanded 100 basis points to 2.9 percent as of September 2013. In evaluation, the mean cap rate proved more steady, edging down only about 10 basis points to 7.2 percent. While a delayed effect is still a possibility, forecasting the potential magnitude requires deeper analysis.

Throughout the Great Recession, the Federal Reserve has held the federal funds rate to nearly zero while infusing huge volumes of capital into the financial markets. The expanded period of monetary easing and the absence of government-supported distress sales have boosted the national mortgage market. This paved the way for cap rates and real estate values to bounce back far more quickly than in previous recessions and well ahead of an actual operating recovery. The exception to this trend occurred in multifamily properties, which recovered even faster than the other sectors.

Whereas tough credit underwriting continues to be an obstacle for potential borrowers, the Federal Reserve’s accommodative policies aimed at reducing near-term interest rate risk have aided in the refinancing and restructuring of maturing and difficult loans. This has resulted in more capital entering real estate as a comparatively sound alternative to reduced yield bonds and volatile equity markets.

A Hybrid Investment

Since the market bottomed in 2009-10, commercial real estate investors have favored the greater certainty of top-tier markets and properties with proven cash flows, despite their generally lower yields; this focus on prime markets limited meaningful price recovery to coastal and urban core markets, until investor interest began to spread a year-and-a-half ago. With most gateway primary markets having substantially recovered, occupancy and rent growth momentum has expanded to late-recovery secondary and tertiary metros. These areas may garner higher yields and offer room for net operating income gains, but they also carry higher risk. Many of these areas face relatively higher overdevelopment threats, less consistent demand, and more shallow liquidity, all of which could affect investor exit strategies. Reflecting these trends, the maturing primary markets have faced slowing cap rate compression and even rate upticks. Conversely, cap rates in secondary markets have tightened, supported by stronger operational momentum and sales volume. Naturally, investor risk will depend in part upon a market’s position along the arc of the real estate cycle and the investment time horizon.

The hybrid nature of commercial real estate makes it a compelling investment option, with a bond-like cash flow component even during economic downturns, as well as an appreciation component that often acts as a hedge against inflation, considering that property owners benefit from increasing rents and property values when inflation rises. In addition, many long-term leases contain consumer price index rent increases, while shorter-term leases allow investors to quickly adjust to market rates.

Rising Interest Rates

A period of falling cap rates helps elevate returns via appreciation. Rising interest rates — reflecting stronger economic activity — generally exert upward pressure on cap rates, requiring an increased emphasis on income growth to offset slower appreciation and higher financing cost. However, healed and expanding credit markets, strong global investor demand for U.S. real estate, and continued recovery in property fundamentals will help counterbalance the magnitude of rising rates, and lend support to property values. Having already absorbed a significant increase in interest rates, further cap rate changes should tie less to speculation regarding Fed policy and correlate more with measurable economic performance.

Debt and equity markets should remain stable for the foreseeable future. However, the environment is not without risk, and near-term volatility should be expected. The pending appointment of a new Federal Reserve chief, looming debt ceiling discussions, geopolitical tensions in the Middle East, and the effects of sequestration and declines in federal spending will hamper economic growth.

In addition, changes in monetary policy always present a risk to the economy. In this light, the Fed has demonstrated considerable dexterity, and should gradually exit qualitative easing in an orderly manner by slowly decreasing bond purchases and letting some securities mature. The Federal Open Market Committee has issued interest rate guidance, stating that the federal funds will remain range-bound between 0 to .25 percent at least until mid-2015, underscoring that monetary tightening would begin only after an economic and employment recovery has been well established. The Fed also noted that the tightening process would occur at a more gradual pace than historical precedent.

Surely, higher interest rates will impact investors across the board. As financing costs rise, so will investors’ required returns. At a minimum, increased financing costs will decay some of the cap rate arbitrage of buying into secondary and tertiary markets, or value-add and opportunistic assets. However, the stride of occupancy and lease growth is likely to exceed that of primary markets and core assets for the midterm outlook. Demand for all commercial real estate, sustained by the reinforcing economy, remains solid, and supply risks are negligible for most property types. As a result, performance profits and other components will considerably counteract the effect of rising interesting rates, at least for the near term. William Hughes